Amortization of assets calculation

Calculating EBITDA Calculating EBITDA involves. Calculating the amortization of an intangible asset is like.

What Is Amortization Definition Formula Examples

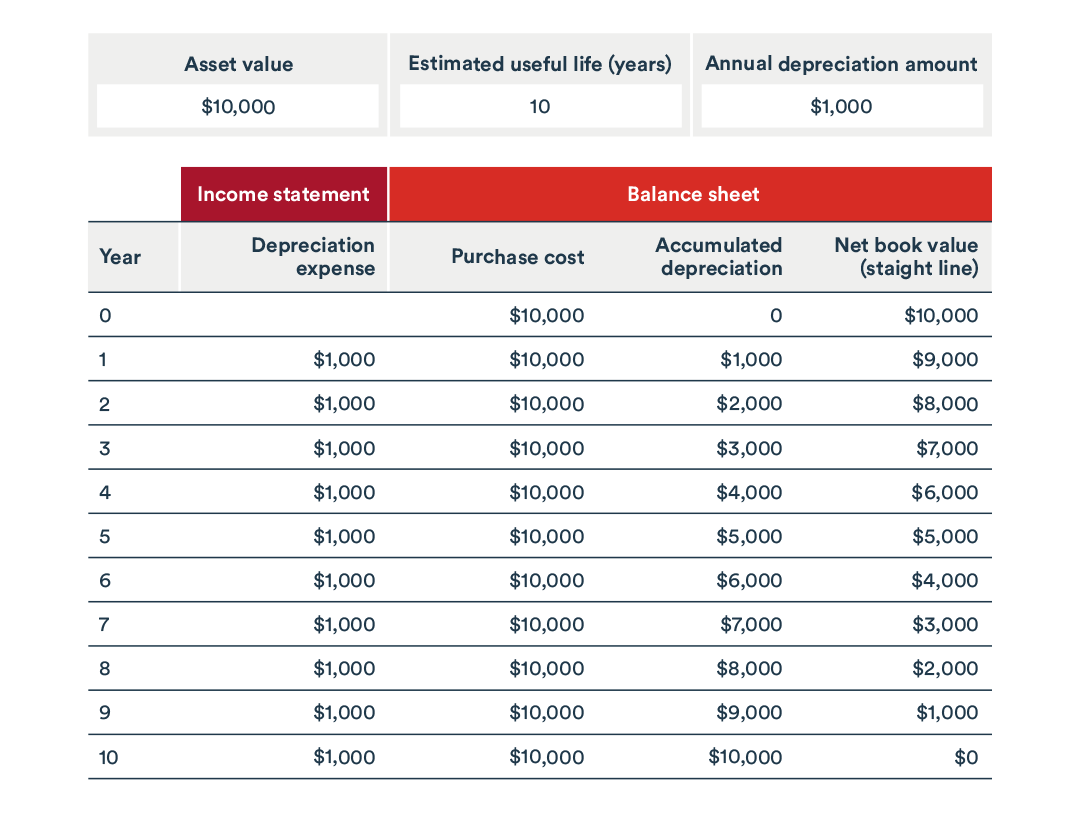

Subtracting the residual value -- zero -- from the 10000 recorded cost and then.

. If useful life is not correct the amortizing cost. Guidance is provided by accounting and tax rules on how to calculate the depreciation of the assets over. Below are the few disadvantages of amortization of intangible assets.

The first is the systematic repayment of a loan over time. The formula to calculate amortization is Cost of an asset Residual value Useful life of the asset. Amortization of Intangible Assets Formula Under the straight-line method an intangible asset is amortized until its residual value reaches zero which tends to be the most frequently used.

The company will use the straight-line method to report the amortization of the software. Our Resources Can Help You Decide Between Taxable Vs. Subtracting the residual value -- zero -- from the 10000 recorded cost and then.

Amortisation refers to the routine decline in value of an intangible asset over time. There is yet another method but it is not so common. Holded will take into account the type of amortization when generating the table and the corresponding entry.

After a few years of using the asset if the company finds out that the intangible asset is. Get Low Rates a Free Quote Today. The most capable and trusted financial calculation solution since 1984.

In the assets section you can make both monthly and annual amortization. There are two general definitions of amortization. Find the basis and residual value.

To calculate the value of assets we use two approaches- One is Depreciation and the other one is Amortization. Easily Calculate Loans APRs and More. In the case of intangible assets amortization refers to the act of depreciation.

The second is used in the context of business accounting and is the act of. The company will use the straight-line method to report the amortization of the software. Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income.

You can follow these steps to calculate the amortization for an intangible asset. It is also used to describe the repayment of a loan or finance agreement over a period of time. Ad Leading Software for Amortization.

Recall that amortization in EBITDA involves expensing intangible assets rather than tangible assets over their useful life. It is difficult to calculate the useful life of an intangible asset. Ad Calculate your Loan Amount.

Amortization Of Intangible Assets Formula And Calculator Excel Template

Amortisation Double Entry Bookkeeping

What Is Amortization Bdc Ca

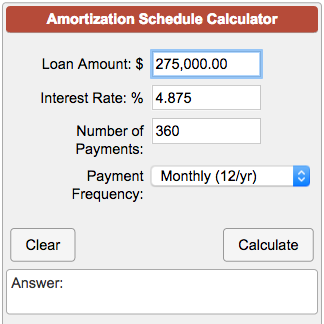

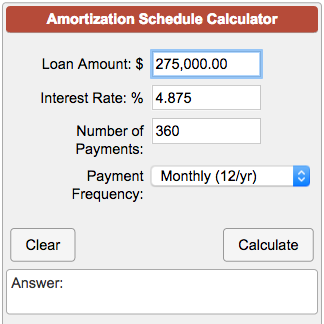

Loan Amortization Calculator

Depreciation Formula Calculate Depreciation Expense

Amortization Of Intangible Assets Formula And Calculator Excel Template

How To Calculate Amortization For Intangible Assets Universal Cpa Review

Amortization Schedule Calculator

Bond Amortization Schedule In Excel Template Amortization Schedule Excel Templates Schedule

Amortization Of Intangible Assets Formula And Calculator Excel Template

Depreciation Of Fixed Assets Double Entry Bookkeeping

What Is Amortization Bdc Ca

How To Calculate Amortization For Intangible Assets Universal Cpa Review

Times Interest Earned Formula Advantages Limitations In 2022 Accounting And Finance Accounting Basics Financial Analysis

Ebitdarm Meaning Importance And Shortcomings Learn Accounting Accounting And Finance Finance Investing

Depreciation Vs Amortization Top 9 Amazing Differences To Learn Accounting Notes Accounting Basics Instructional Design

Ev To Ebitda Meaning Formula Interpretation And More Enterprise Value Money Management Advice Learn Accounting