Percentage of federal taxes taken out of paycheck

The federal income tax has seven tax rates for 2020. 400 up to 11300.

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes.

. Also What is the percentage of federal taxes taken out of a paycheck 2021. 300 on income up to 8400. When it comes to Social Security taxes the employer withholds 62 percent of the employees wages and contributes another 145 percent.

The first 3100 you earn in taxable income is taxed at 100. Your bracket depends on your taxable income and filing status. There is a wage base limit on this tax.

62 of each of your paychecks is withheld for Social Security taxes and your employer contributes a. This is divided up so that both employer and employee pay 62 each. The federal income tax has seven tax rates for 2020.

15 Tax Calculators. Your 2021 Tax Bracket To See Whats Been Adjusted. The employer portion is 15 percent and the.

10 12 22 24 32 35 and 37. For the 2021 tax year. Social Security tax and Medicare tax are two federal taxes deducted from your paycheck.

The rate jumps to 200 on income above 3100 and up to 5500. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. 10 percent 12 percent 22 percent 24 percent 32 percent 35.

Discover Helpful Information And Resources On Taxes From AARP. The federal government receives 124 of an employees income each pay period for Social Security. What is the percentage that is taken out of a paycheck.

Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or. What percentage of federal taxes is taken out of paycheck for 2020. Next up is federal income tax withholding.

For the first 20 pay periods therefore the total FICA tax withholding is equal to or. Exactly how much your employer. The Social Security tax is 62 percent of your total pay.

The only way you can get around this is if your income is very low. What percentage of taxes are taken out of payroll. There are seven federal tax brackets for the 2021 tax year.

This all depends on whether youre filing as single married jointly or married separately or head of household. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or. Also known as a Federal Tax ID number your unique EIN.

You pay the tax on only the first 147000 of your. What percentage is taken out of paycheck for federal taxes. Federal income tax rates range from 10 up to a top.

These taxes are deducted from your paycheck in fixed percentages. You owe tax at a progressive rate depending on how much you earn. Thats because the IRS imposes a 124 Social Security tax and a 29 Medicare tax on net earnings.

Ad Compare Your 2022 Tax Bracket vs. What percentage of federal taxes is taken out of paycheck for 2020. These are the rates for.

Do this later. How much federal tax is taken out of your paycheck will also be determined by your tax bracket the more income you earn the higher percentage tax bracket you might. Paycheck Tax Calculator.

FICA contributions are shared between the employee and the employer. 10 percent 12 percent 22 percent. Elected State Percentage.

For instance the first 9525 you earn each year will be taxed at a 10 federal rate. The employee pays the remaining. Since 142800 divided by 6885 is 207 this threshold is reached after the 21st paycheck.

How Your Louisiana Paycheck Works. Federal Paycheck Quick Facts. For the 2019 tax year the maximum income amount that can be.

The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one.

Calculate My Paycheck Shop 57 Off Www Ingeniovirtual Com

Texas Paycheck Calculator Smartasset

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Calculate My Paycheck Shop 57 Off Www Ingeniovirtual Com

Payroll Deductions As Liabilities Vs Payroll Expenses

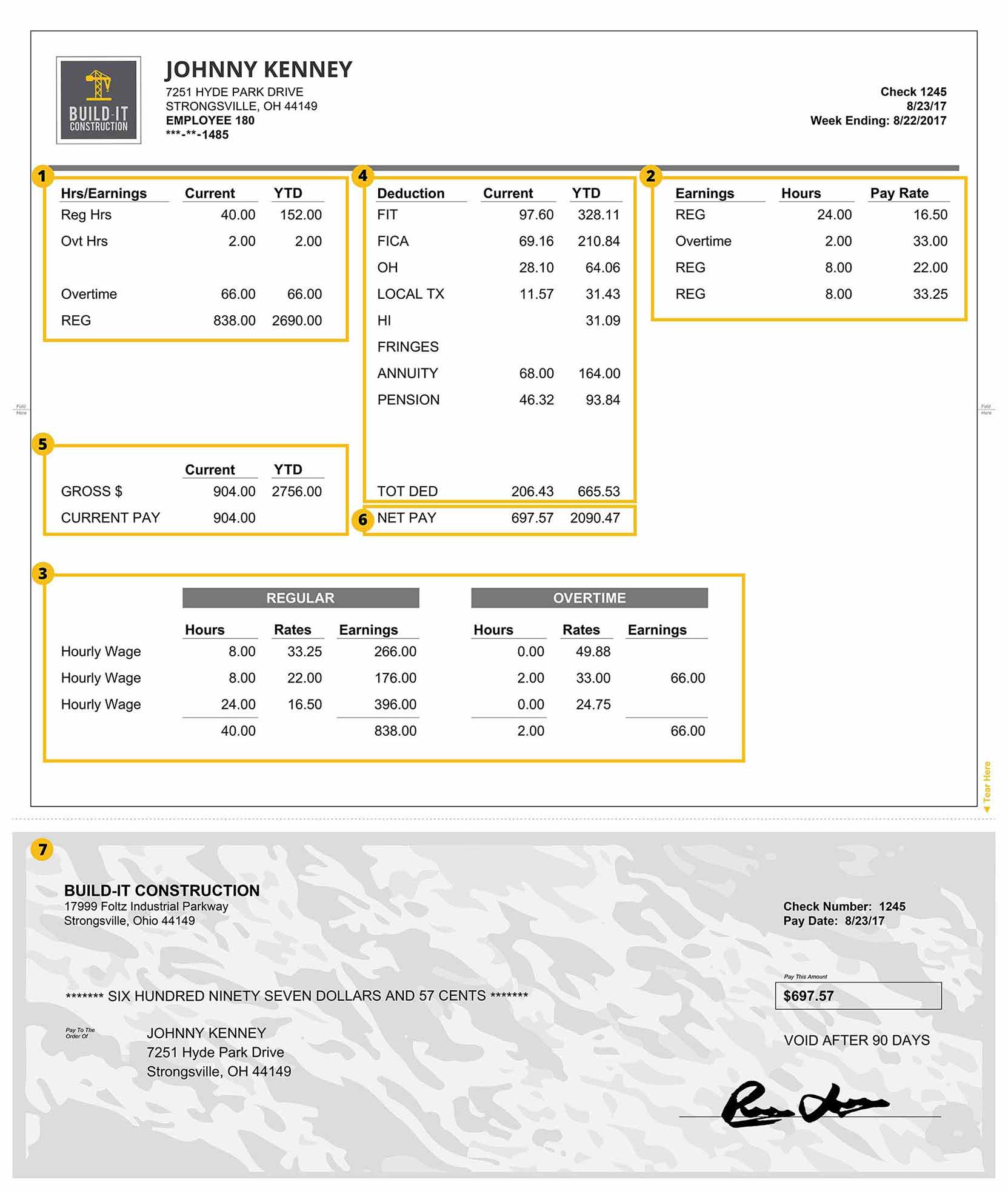

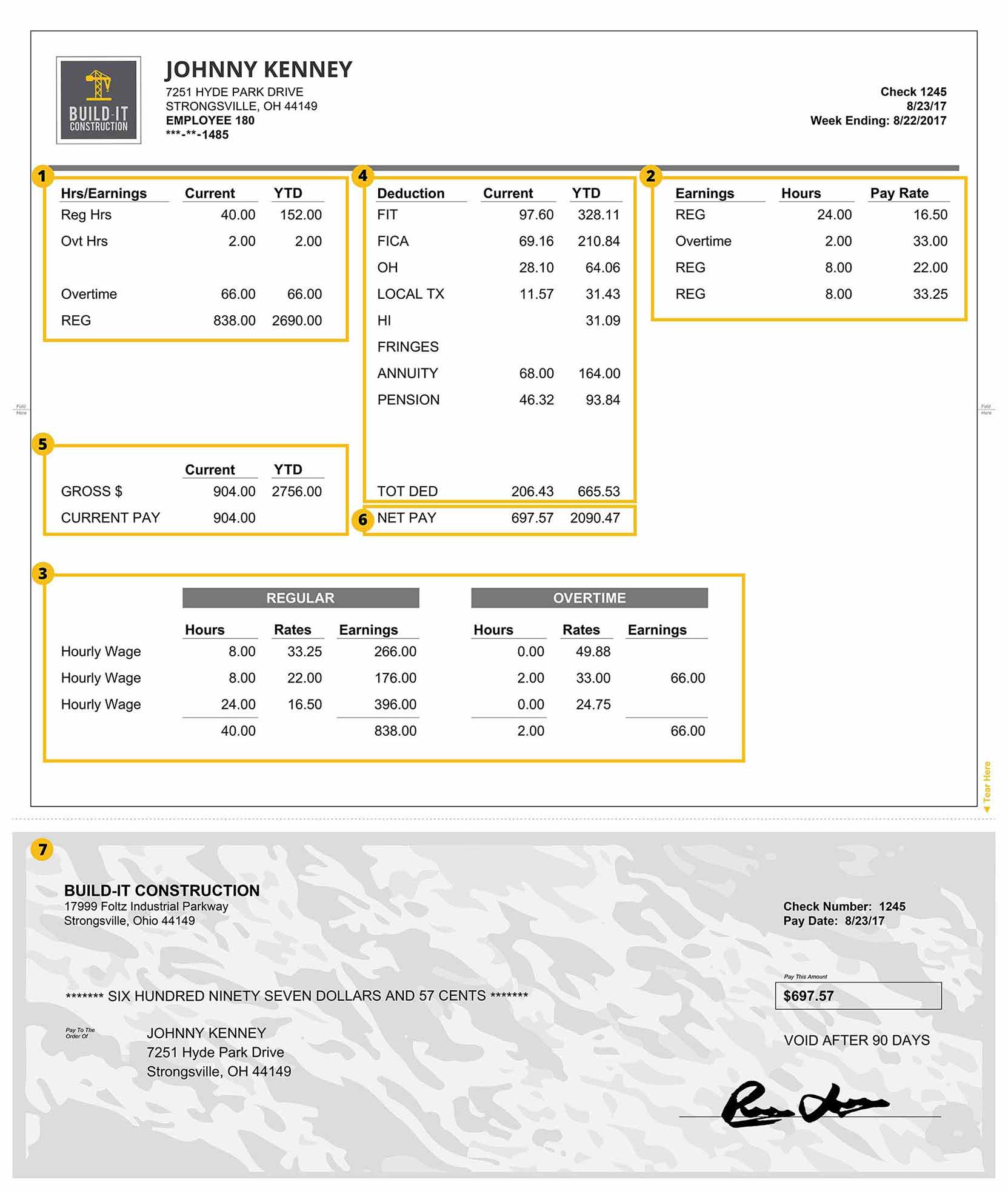

A Construction Pay Stub Explained Payroll4construction Com

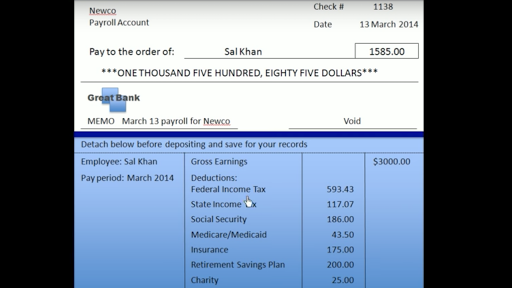

Anatomy Of A Paycheck Video Paycheck Khan Academy

Why Is 33 Of My Paycheck Being Taken For Taxes Quora

Taxes Calc Hotsell 53 Off Www Ingeniovirtual Com

Adjust Your Withholding To Ensure There S No Surprises On Tax Day Tas

Understanding Payroll Taxes And Who Pays Them Smartasset

Anatomy Of A Paycheck Video Paycheck Khan Academy

Payroll Tax Vs Income Tax What S The Difference

Irs New Tax Withholding Tables

What Exactly Gets Taken Out Of Your Paycheck Tax Deductions Paycheck Payroll

Payroll Tax Calculator For Employers Gusto